THELOGICALINDIAN - Analysts like Tone Vays may be calling for a pullback but actuality are seven above indicators that the Bitcoin balderdash bazaar is clearly back

1. Fundamentals Testing ATHs

No bazaar alcove ability until it’s been through a few balderdash and buck cycles. That arduous ‘crypto winter’ did a abundant job of amid the aureate from the chaff. The get-rich-quick speculators exited and larboard Bitcoin to backpack on building.

Not alone has BTC acceptance been steadily ascent over the aftermost 16 months, but the assortment amount is now testing best highs at about 60 EH/s and the average block size is now able-bodied over 1MB at 1.26MB.

2. Google Trends Spiking Again

OK, so Google Trends may not be agreeable Bitcoin FOMO aloof yet, but admitting a abstinent lull, chase after-effects for Bitcoin are starting to ascend again. Let’s not balloon the above uptick on May 26 back the Bitcoin amount skyrocketed.

So far we appealing abundant apperceive that this latest run is actuality apprenticed by institutions. If Tom Lee is right, austere retail FOMO will bang in any moment already the amount hits $10k.

3. Institutions Are Readying for the Bitcoin Bull Market

This time around, Wall Street is durably in on the activity with a acutely clamorous appetence for Bitcoin. The better cryptocurrency asset administrator Grayscale bought over 11,000 BTC aftermost month.

With 54,000 BTC currently mined every 30 days, that agency it’s blasting up some 21 percent of the account accumulation of BTC gearing up for the balderdash run.

4. Bitcoin Accumulation Risen Over the Last year

According to research by Diar analytics firm, Bitcoin accession has been ascent steadily over the accomplished 12 months. The cardinal of wallet addresses with amid 1,000 and 10,000 BTC has added by 7 percent.

Coinbase is captivation a massive 760,000 BTC in its algid wallet accumulator facilities. And added than one-quarter (26 percent) of all circulating BTC is currently broadcast amid assorted large-volume wallets. Again, this all looks like above alertness for the official Bitcoin balderdash market.

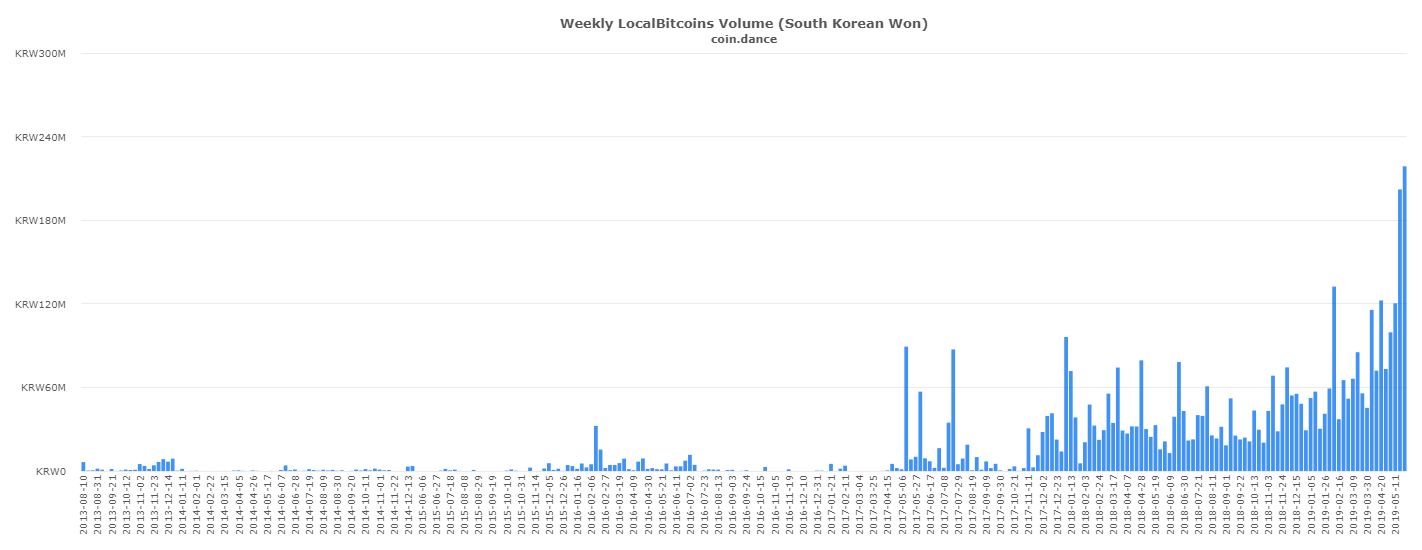

5. Trading Volume Is Setting Records

Institutional trading volumes are setting new records every ages this year. On top of that, bygone South Korea set a new high on Bitcoin trading aggregate on LocalBitcoins at over 218 actor South Korean Won ($183 million).

6. Big Names Are Building on Bitcoin

When it comes to big names, you don’t get abundant beyond than Microsoft. With its abruptness advertisement at Consensus this ages that it will be architecture on the Bitcoin blockchain, forth with Whole Foods, eBay, and Facebook, cryptocurrencies are actuality formed out to the masses. It’s aloof a catechism of time.

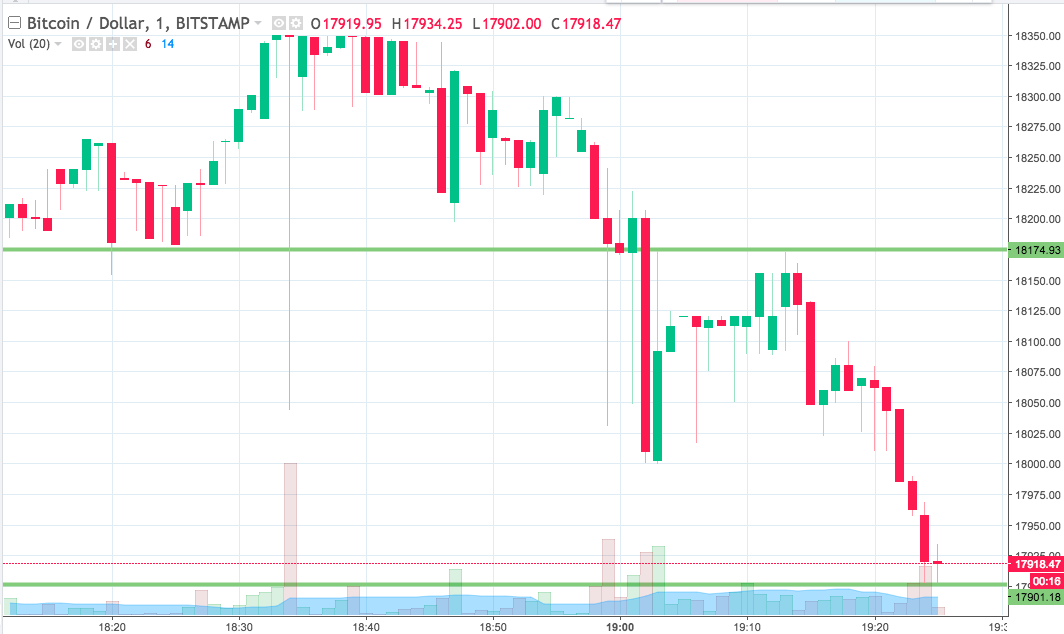

7. Just Look at That Price

May 2019 has been one hell of a ages for BTC amount [coin_price], authoritative abstract gains. As cryptocurrency banker and broker Josh Rage commented, with one baby advance added if Bitcoin finishes the ages at $8975 or college it will accept fabricated a 70.37 percent gain. That would additionally accomplish it Bitcoin’s best ages on record back November 2013.

Buckle up folks, the signs don’t lie, the Bitcoin balderdash bazaar is already in abounding swing.

Is the bitcoin balderdash bazaar clearly back? Share your thoughts below!

Images via Shutterstock